Written by James Horrocks MRICS, Senior Director at COREP | An NAI UK Company

A transformational shift in corporate real estate strategy is upon us and in this In Focus article, we examine the key changes in office space utilisation pre- and post-COVID that dictated the evolution of office space, focusing on trends that have emerged, challenges faced, and the long-term implications for corporate occupiers.

The pandemic has left a significant mark on various facets of our lives, with the commercial office space sector being one of the most affected. Prior to the pandemic, office spaces were seen as essential hubs where corporate culture thrived and where physical presence was paramount. However, as the global health crisis unfolded, many companies were forced to adapt to remote working models, leading to a dramatic shift in office space utilisation.

Pre-COVID Office Utilisation Trends

Before 2020, office utilisation was built on traditional principles of full occupancy. Companies expected their employees to be on-site for most of the workweek, with office utilisation rates in major cities ranging from 60% to 80%. Offices were primarily designed with individual workstations, and open-plan layouts were becoming more common to foster collaboration and optimise space.

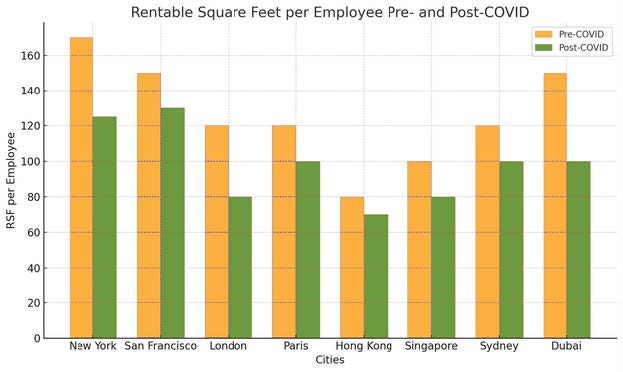

On average, the RSF (rentable square feet) per employee ranged from 150 to 200 square feet in the U.S., with companies in NY and San Francisco leading the trend toward tighter space utilisation. In the UK, particularly in London, the typical range

was between 100 and 150 square feet, with many organisations targeting space optimisation to counter rising real estate costs. Across Europe and Asia-Pacific, similar trends were seen, with companies leveraging open-plan office designs to reduce costs.

The Pandemic’s Impact on Office Utilisation

The pandemic caused an unprecedented disruption in office space utilisation, prompting widespread adoption of remote and hybrid work models. By 2021, 70-80% of large corporations embraced flexible working and significantly reduced their need for full-time office space.

With remote work proving viable across industries, office utilisation rates dropped substantially from pre-pandemic highs of 60-80% to 20-30% in 2021, leading to companies downsizing their office space across various industries.

Companies in high-rent cities such as London, NY, and San Francisco reduced their office footprints by 10-30%, and many adopted hot-desking and flexible workspace models.

Post-COVID Trends in Office Space Utilisation

As businesses began to stabilise in the wake of the pandemic, new trends in office space emerged. While office utilisation rates have recovered somewhat, reaching 40-60% in many regions by 2023, the nature of how office spaces are used has fundamentally changed. Key trends include:

Hybrid Work Models

The hybrid work model is now the dominant approach for many companies. By 2022, 25-30% of U.S. employees were working remotely at least part of the time, with even higher percentages in industries such as technology, finance, and professional services.

Downsizing and Hot-Desking

Downsizing by 10-30% has become a common strategy as companies move to more flexible, cost-effective models. Hot-desking has gained traction as a space-saving measure and desk-sharing ratios are becoming increasingly popular, particularly in sectors that rely on flexible work arrangements.

Increased Collaboration Spaces

Post-pandemic office designs are prioritising collaborative areas over individual workstations. Open-plan layouts remain prevalent, but there has been a shift toward creating more meeting rooms, breakout areas, and social spaces to facilitate in-person collaboration when employees are in the office. Companies are reconfiguring their spaces to accommodate this new emphasis on teamwork and interaction, reflecting the changing nature of work in a hybrid world.

Flexible Workspaces and Short-Term Leasing

The demand for flexible office spaces, such as those offered by WeWork or Regus, has surged in the post-COVID era. Companies are increasingly opting for short-term leases and co-working spaces that offer the flexibility to scale up or down depending on business needs. This trend is particularly evident in major cities where long-term leasing commitments are being replaced by more adaptable solutions.

Health and Wellness Integration

While office designs are being optimized for space efficiency, there has also been a focus on health and wellness measures. Open spaces, better ventilation, and safety protocols have become key considerations in post-pandemic office layouts. Although these changes have not significantly increased the RSF per employee, they reflect a broader concern for employee well-being in the workplace.

“Within our organisation, post-COVID, we have seen a significant shift from traditional office utilisation to a flexible/ hybrid approach. The benefits, from a financial, operational and human perspective, are significant if executed and managed correctly. Increasingly, our employees are experiencing the benefiots of having access towell-amenitized, collaborative workplace environments, which alongside the flexibility our hybrid working philosophy offers, helps our people to be highly productive and engaged on a day-to-day basis. We expect this trend to continue, and we endeavour, subject to local nuances and situations, to continue to implement and adapt throughout our EU portfolio.”

Lee Childs, Director or Sourcing at Westcon.

The Impact on Corporate Real Estate and Leasing Markets

Vacancy rates in major cities rose sharply during the pandemic, with some markets experiencing rates as high as 15-25%, compared to pre-pandemic levels of 8-10%. Cities like New York, San Francisco, and London saw significant increases in vacant office spaces as companies reconsidered their long-term leasing commitments

The rise of flexible workspaces has also altered the leasing landscape. Corporate occupiers are increasingly seeking shorter lease terms and more adaptable office environments that can accommodate fluctuating workforce sizes.

Co-working spaces, which offer flexibility without the need for long-term commitments, have gained traction among companies looking to reduce costs and increase agility in the post-COVID world.

Conclusion: A New Era of Office Utilisation

The COVID-19 pandemic has permanently transformed the way companies use office spaces. The widespread adoption of hybrid work models, downsizing, and the growing demand for flexible workspaces all point to a future where corporate real estate strategies are more dynamic and adaptable than ever before. Companies are now focusing on maximising efficiency, reducing unnecessary space, and fostering collaboration in ways that align with the evolving nature of work.

As businesses continue to navigate the post-pandemic world, the office environment will remain a critical part of corporate culture. However, the days of full-time office occupancy and rigid work schedules are likely behind us. In their place, we will see a more fluid approach to office space utilisation, driven by flexibility, collaboration, and the ongoing integration of technology into the workplace. For corporate occupiers and real estate professionals alike, the challenge will be to adapt to these changes while continuing to optimize their office portfolios for the future.

Direct enquiries relating to this article, please contact James Horrocks on jhorrocks@naiuk.com.

Press enquiries, please contact Kelly Duncan on kellyd@corep-group.com.

No responses yet