Written by Matt Swash MRICS SIOR, Managing Director at COREP | An NAI UK Company

In the post-pandemic world, the commercial office market has undergone significant systemic change. For commercial tenants, especially those occupying premium spaces in central business districts, understanding the evolving dynamics of prime office rents is crucial. The global economy is steadily recovering, but the lingering impacts of COVID-19 and the adoption of hybrid work models are reshaping demand and rental rates. This article provides insights into prime office rent trends in key global cities from 2019 to 2024, offering tenants a strategic perspective on market conditions.

1. The Global Office Market Pre-COVID

Before COVID-19, prime office rents in major cities were experiencing robust growth, driven by economic expansion, urbanization, and a competitive market for premium office space. Cities like New York, London, and Hong Kong were among the most expensive in the world, with companies seeking centrally located, high-spec office spaces to accommodate growing teams.

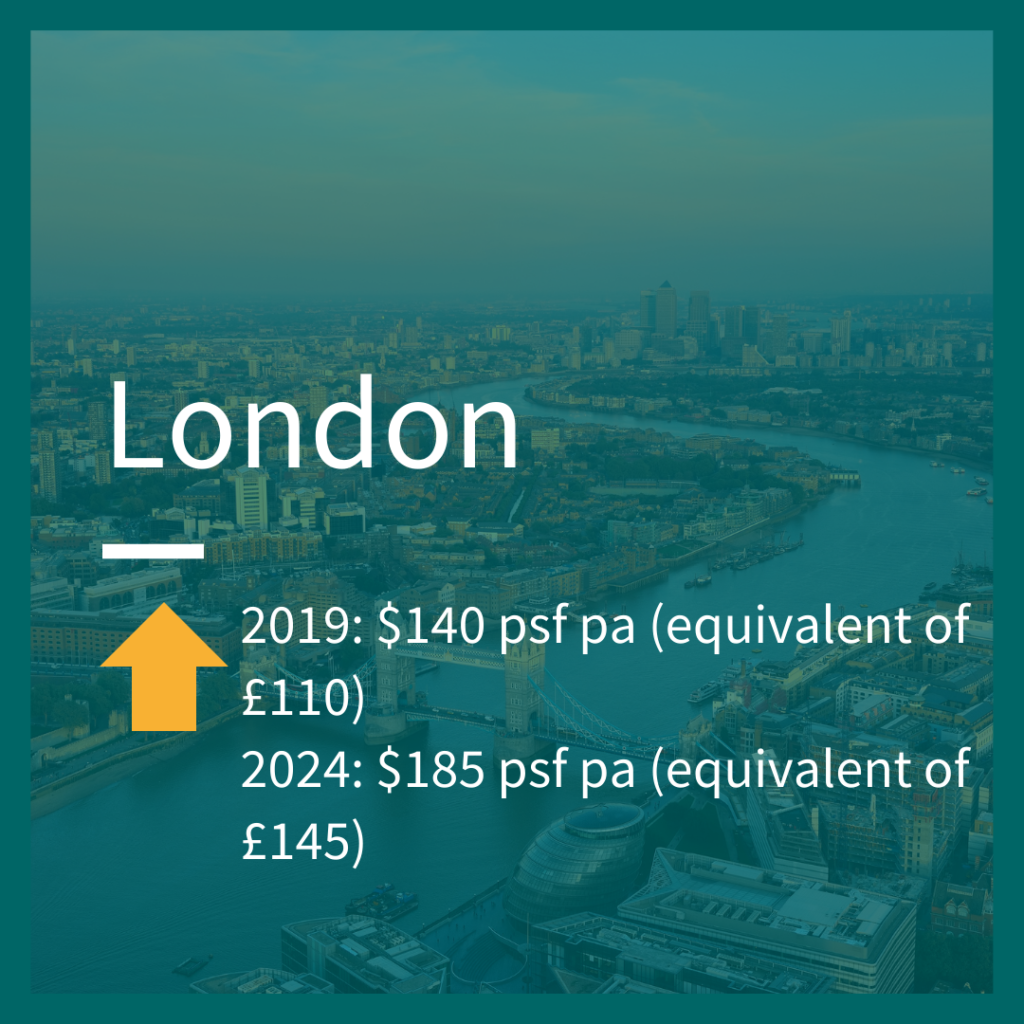

In 2019, the commercial office market was characterized by high demand and limited supply in key CBDs, leading to rising rents across most global cities. The trend was particularly strong in financial hubs like London’s West End and New York’s Midtown, where prime office rents soared to $140 psf pa and $90 psf pa (higher for premium space), respectively.

2. The Pandemic’s Impact on Prime Rents

The onset of the COVID-19 pandemic in early 2020 disrupted the commercial real estate market worldwide. With businesses forced to adapt to remote working and economic uncertainty, demand for office space dwindled, leading to higher vacancy rates and downward pressure on rents. The shift to hybrid working has prompted tenants to rethink their office needs, driving a global recalibration of rental prices, particularly in cities where the tech sector plays a major role.

3. 2024: The New Normal for Prime Office Rents

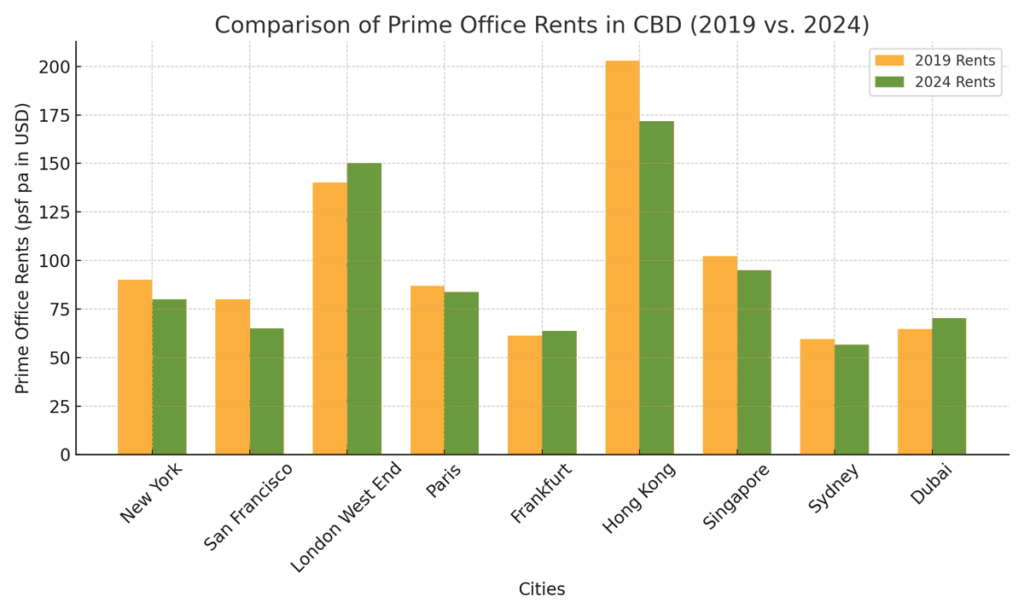

As we edge closer toward the end of 2024, the global office market is in the process of recalibrating. Some cities are experiencing a slow recovery, while others are seeing stronger rebounds as businesses resume office-based operations. Here’s a breakdown of key global cities, comparing their 2019 and 2024 prime office rents:

New York’s prime office market has seen rents decline as businesses continue to downsize or shift to hybrid working models. While there is still strong demand for premium space, especially in Midtown, vacancy rates remain higher than pre-pandemic levels, contributing to a moderate softening in rents. Commercial tenants are finding more opportunities to negotiate favorable terms as landlords adjust to market realities.

San Francisco, with its tech-driven economy, has experienced one of the steepest declines in prime office rents. The tech sector’s embrace of remote work has left a surplus of office space, and tenants can now secure prime real estate at significantly lower rates than in 2019. For businesses willing to invest in office space, San Francisco presents an opportunity to lock in favorable rents.

London’s West End submarket remains one of the world’s most resilient office markets, with strong demand for prime space driven by the financial and legal sectors. Rents in 2024 have surpassed 2019 levels, reflecting the ongoing scarcity of high-quality, centrally located space. Across Central London, securing prime office space—whether in the West End or City—remains challenging. Intense competition and the prominence of pre-let transactions require occupiers to plan further ahead. Forthcoming changes to Minimum Energy Efficiency Standards are also beginning to have a widespread impact.

Paris has remained relatively stable, with only a slight decrease in rents. The French capital’s diversified economy and its appeal as a business hub have kept demand steady. However, the focus has shifted towards flexible spaces, with tenants looking for shorter lease terms and more adaptable office configurations. For tenants, the Paris market offers stability, but flexibility will be key in lease negotiations.

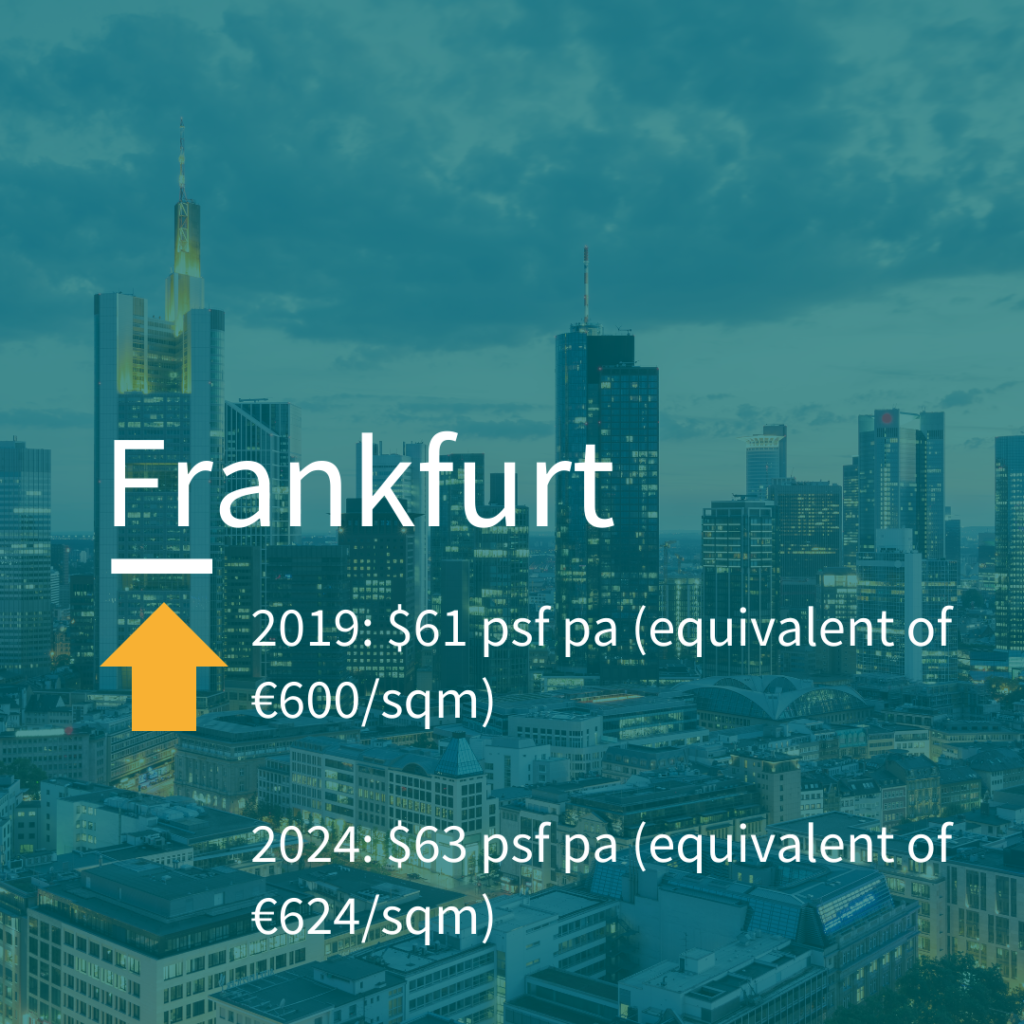

Frankfurt, as the financial capital of mainland Europe, has seen prime rents hold steady. The city benefits from a strong financial sector, and with businesses continuing to prioritize high-quality office space in the CBD, rents have remained relatively stable with a slight uptick. Tenants in Frankfurt should expect modest price increases, but opportunities still exist for negotiation in the face of evolving work models.

Hong Kong, traditionally one of the world’s most expensive office markets, has seen a significant decline in prime office rents. Political unrest, coupled with the impact of the pandemic, has led to a softening in demand. For tenants, this presents an unprecedented opportunity to secure prime office space at a lower cost than in previous years. However, market volatility remains a concern, and businesses should approach lease negotiations with caution.

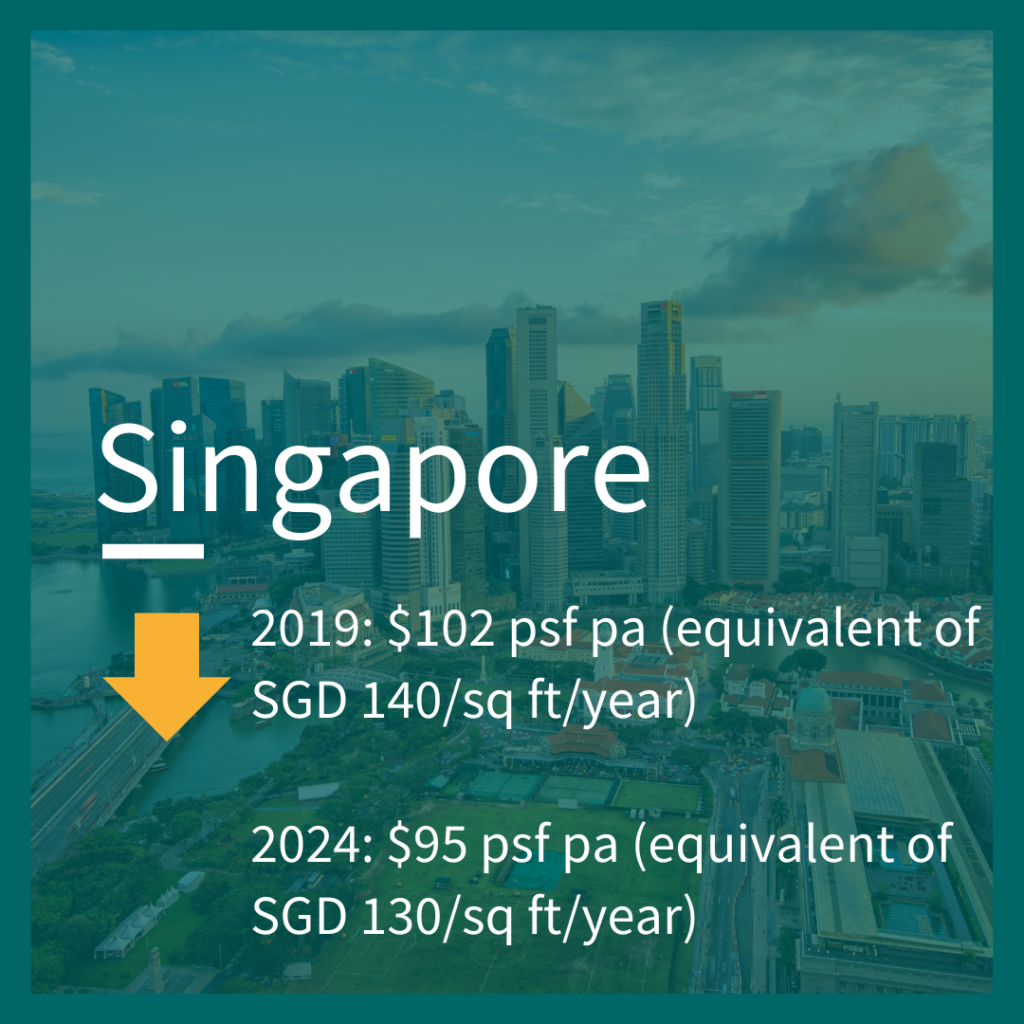

Singapore, with its strong position as a financial and business hub in Asia, has seen a slight dip in prime office rents. However, the city’s reputation for stability and its business-friendly environment continue to attract multinational corporations. Tenants should still expect relatively high costs, but opportunities for negotiating incentives, such as fit-out contributions or rent-free periods, may arise.

Sydney’s office market remains competitive, but vacancy rates have increased slightly due to the ongoing shift to remote work. This has led to a modest decline in prime office rents. For tenants, Sydney offers a good balance between cost and location, especially for those looking to secure space in the city’s CBD at slightly lower rates than in 2019.

Dubai’s prime office market has shown resilience, with rents increasing slightly as the city rebounds from the pandemic. Dubai’s proactive approach to handling the economic downturn and its appeal as a global business hub have helped keep demand for prime office space high. Tenants in Dubai should be prepared for slightly higher rents, but favorable lease terms may still be negotiable, particularly in newly developed office spaces.

4. Key Takeaways for Commercial Tenants

For commercial office tenants, the current market presents both challenges and opportunities. In cities like San Francisco and Hong Kong, significant rent reductions offer a chance to secure premium space at lower costs. Meanwhile, in resilient markets like London and Frankfurt, securing prime office space may require more aggressive lease negotiations, with flexibility in terms and conditions becoming increasingly important.

As the world adapts to new work models, tenants should focus on securing flexibility in lease agreements, including shorter lease terms, break options, and the ability to adapt space configurations. Furthermore, negotiating incentives like rent-free periods or contributions to fit-out costs can provide additional financial benefits.

The global office market is evolving, and tenants who stay informed and proactive in their lease negotiations will be best positioned to capitalise on the opportunities ahead.

The chart below compares prime office rents for key global cities in 2019 and 2024:

As a member of a Top 10 Commercial Real Estate brand in the world, NAI Global, we are partnered with over 5000 CRE professionals worldwide. If you have any direct enquiries relating to this article, or would like to get in touch about your portfolio, please contact Matt Swash on matts@co-rep.com.

Press enquiries, please contact Kelly Duncan on kellyd@corep-group.com.

No responses yet